ROI: What Is ROI and How It Is Calculated/ROI Formula? The Complete Guide to Understanding of Return on Investment

Return on Investment (ROI) is a financial metric used to evaluate the profitability or efficiency of an investment. It measures the return (profit or loss) relative to the cost of the investment, expressed as a percentage. ROI is one of the most widely used performance measurements because of its versatility and simplicity.

What Is ROI and How It Is Calculated?

The basic formula for calculating ROI is:

ROI = (Net Return / Cost of Investment) × 100%

For example, if you invest $10,000 in a business venture and later receive $15,000 back, your ROI would be:

ROI = ($15,000 - $10,000) / $10,000 × 100% = 50%

This means you earned a 50% return on your investment.

When Is ROI Used?

ROI is a versatile metric used across various business contexts:

- Investment Evaluation – ROI is a crucial metric used to assess the efficiency and profitability of investments. Whether in personal finance or business strategy, it helps compare opportunities and make informed financial decisions.

- Financial Investments – ROI helps investors compare the potential returns of different investment opportunities such as stocks, bonds, real estate, or business ventures.

- Capital Budgeting – Businesses use ROI to evaluate and prioritize potential capital expenditures, like purchasing new equipment, expanding facilities, or launching new product lines.

- Marketing and Advertising Assessment – ROI is an essential tool for marketers to measure the success and profitability of campaigns across various channels. It helps identify what works, optimize spending, and maximize marketing impact.

- Campaign Effectiveness – Marketers use ROI to determine which advertising channels, campaigns, or strategies are generating the best returns.

- Digital Marketing – In digital marketing, ROI helps evaluate the effectiveness of SEO efforts, PPC campaigns, content marketing, social media marketing, and email marketing initiatives.

- Business Strategy and Operations – ROI supports strategic planning by helping businesses allocate resources to initiatives that deliver the highest value.

- Project Selection – When businesses have limited resources, ROI helps prioritize projects that provide the best returns.

- Process Improvement – Companies calculate ROI on operational changes like implementing new software, restructuring departments, or adopting new manufacturing processes.

- Technology Investments – ROI is essential for evaluating the business value of new technologies, and balancing innovation with cost-effectiveness.

- IT Infrastructure – ROI helps justify investments in new technology systems, software, or digital transformation initiatives.

- Automation – When considering automation or AI implementation, ROI calculations can demonstrate the long-term value despite high initial costs.

- Human Resources – ROI helps HR departments demonstrate the impact of people-focused initiatives on organizational performance.

- Training Programs – HR departments use ROI to assess the effectiveness of employee training and development initiatives.

- Hiring Decisions – Companies may calculate the ROI of bringing on new team members or creating new positions.

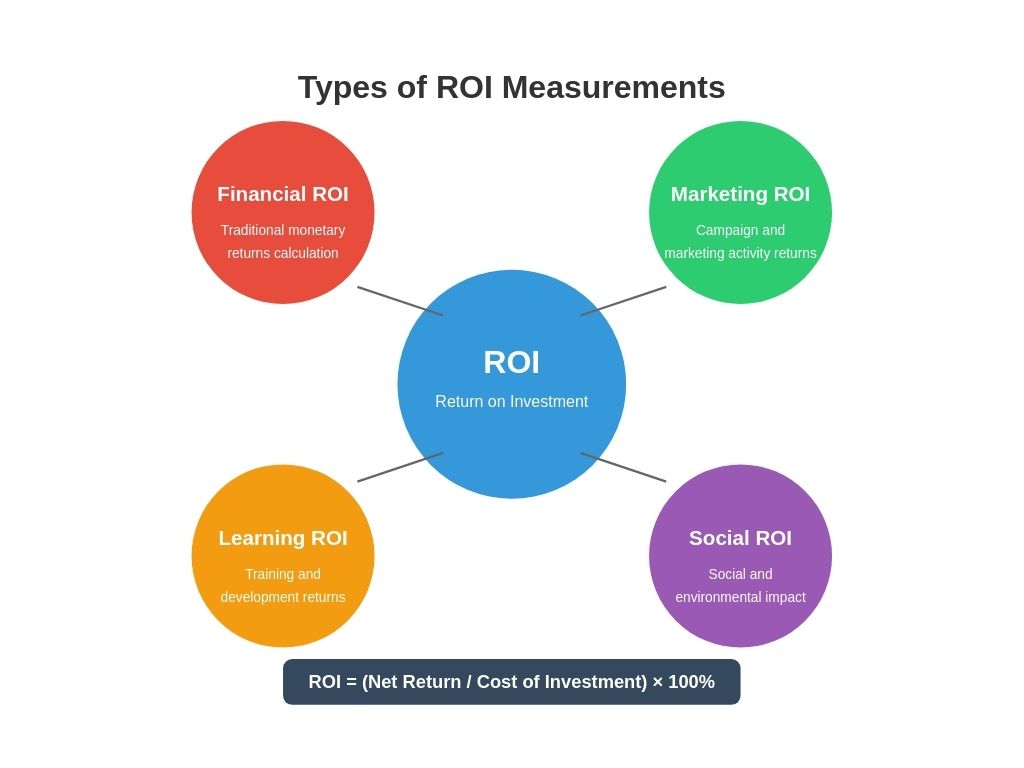

Types of ROI Measurements

ROI can be calculated and interpreted in several ways, depending on the context and goals of the organization:

- Financial ROI – The traditional ROI calculation focuses purely on financial returns. This is the most common form and directly measures monetary gains relative to monetary investments.

- Social ROI (SROI) – Social Return on Investment evaluates the social or environmental value created by a program, organization, or policy in relation to the resources invested. It’s especially relevant for non-profits, social enterprises, and CSR initiatives.

- Marketing ROI (MROI) – MROI measures the return generated from marketing activities. It helps marketers understand which campaigns drive revenue and justify budgets.

- Formula:

MROI = (Incremental Revenue Attributable to Marketing × Contribution Margin − Marketing Investment) / Marketing Investment

- Formula:

- Learning ROI – Used in HR and L&D, learning ROI tracks how training and development programs contribute to business results, such as productivity, quality, or customer satisfaction.

Advantages of Using ROI

ROI (Return on Investment) remains one of the most popular performance metrics thanks to its clarity, versatility, and decision-making value:

- Simplicity and Clarity – ROI is easy to calculate using a basic formula:

(Gain from Investment – Cost of Investment) / Cost of Investment. This produces a single percentage that clearly indicates whether an investment yielded a profit or a loss. Its simplicity allows even non-financial stakeholders to understand the results without needing complex financial expertise. - Comparability – ROI provides a standardized percentage format, which allows side-by-side comparison of vastly different investments. For example, you can compare the ROI of a marketing campaign to that of a new software tool or equipment upgrade—even if the costs, timelines, and outcomes vary. This comparability makes ROI a useful decision-making tool for portfolio analysis and resource prioritization.

- Universality – One of ROI’s greatest strengths is its universal applicability. It can be used in virtually any business context: finance, marketing, human resources, technology, operations, and more. This makes ROI a “common language” for evaluating performance across departments, aligning diverse teams with a shared focus on results.

- Decision Support – ROI helps managers and stakeholders make informed choices by quantifying the potential or actual returns of different options. Instead of relying on gut feelings or assumptions, ROI provides concrete data to back investment decisions, support business cases, and allocate budgets more effectively.

- Cost Awareness – By making the relationship between cost and return visible, ROI promotes financial discipline. It encourages teams to scrutinize spending and focus on activities that generate the most value, helping reduce wasteful or low-impact investments.

- Goal Alignment – ROI aligns projects and initiatives with organizational goals, especially financial ones. If a project consistently delivers low or negative ROI, it may indicate a misalignment with broader business objectives, helping teams refocus on what truly matters.

- Flexibility – ROI is not a one-size-fits-all tool—it can be adapted to different time frames (monthly, quarterly, annually) and to different types of investment (monetary, time, effort, or resources). This makes it suitable for both short-term tactical decisions and long-term strategic planning.

- Risk Identification – A poor or declining ROI can act as a warning sign that an initiative is underperforming or that external risks (like market shifts or operational inefficiencies) are impacting returns. This early insight helps managers pivot before losses escalate.

- Performance Benchmarking – ROI can be used to benchmark performance over time or against industry standards. Businesses can track how the return on a particular type of investment improves or declines, and make strategic adjustments accordingly.

- Communication Tool – ROI’s straightforward format makes it a powerful communication tool for presentations, reports, and pitches. Whether addressing internal stakeholders or external investors, ROI helps clearly convey the value of an initiative in a language everyone understands.

- Supports Continuous Improvement – Because ROI encourages regular measurement and evaluation, it supports a culture of accountability and optimization. Teams are more likely to reflect on past performance and seek ways to improve outcomes.

- Encourages Strategic Thinking – ROI pushes decision-makers to think long-term about outcomes, not just immediate results. It encourages evaluation of opportunity costs and fosters a mindset focused on maximizing total value over time.

- Helps Justify Innovation and Change – New technologies, automation, or process improvements often require upfront investment. ROI can be used to demonstrate long-term gains, helping justify changes that may otherwise seem costly or risky.

Limitations of ROI

While ROI is a widely used and valuable performance metric, it’s important to recognize its limitations. Understanding these drawbacks helps avoid misinterpretation and ensures ROI is used in the right context:

- Time Value of Money – The standard ROI formula doesn’t consider the time value of money — the principle that money available today is worth more than the same amount received in the future. This can lead to misleading results, especially for long-term investments. Alternative metrics like NPV (Net Present Value) or IRR (Internal Rate of Return) may provide a more accurate picture in such cases.

- Risk Considerations – ROI calculations do not inherently include risk factors. Two investments may show identical ROI values, but one may carry significantly higher uncertainty or volatility. Without risk-adjusted analysis, ROI can overstate the appeal of risky ventures.

- Short-Term Focus – Relying heavily on ROI can lead to short-termism, where decision-makers prioritize quick returns over sustainable long-term value. For example, cutting costs to boost short-term ROI might harm customer experience or product quality.

- Non-Financial Benefits Excluded – Traditional ROI focuses solely on monetary gains, often ignoring intangible benefits like brand equity, customer loyalty, employee satisfaction, or social impact. This limits its usefulness in contexts where non-financial outcomes matter.

- Doesn’t Capture Opportunity Cost – ROI doesn’t account for the opportunity cost of choosing one investment over another potentially better one. A project with 20% ROI might seem attractive, but if another opportunity could generate 30%, it represents a missed gain.

- No Standardized Formula – One of the major weaknesses of ROI is that there’s no single, universally accepted formula used across all industries, departments, or types of investments. While the basic formula

ROI=(Return–Investment)/Investmentseems simple, how “return” and “investment” are defined can vary significantly, and that opens the door to confusion or manipulation. For example:- Gross vs. Net Return – One calculation might use gross revenue as the return, while another subtracts operating costs to get net profit. This difference can drastically affect the ROI percentage.

- Pre-Tax vs. Post-Tax – Some ROI figures include taxes, while others don’t. Comparing a pre-tax ROI with a post-tax ROI is not apples-to-apples, and can lead to incorrect conclusions about profitability.

- Hidden or Indirect Costs – Many ROI calculations fail to include indirect, long-term, or hidden costs, such as:

- Employee time or opportunity cost (e.g., time spent on the project instead of something else)

- Training, maintenance, or support costs

- Implementation delays or disruptions

- Integration with existing systems or processes

- Long-term cost of ownership (especially for software or equipment)

If these aren’t factored into the calculation, the ROI may appear higher than it truly is.

- Different Accounting Practices – In some organizations, capital expenditures may be accounted for differently (e.g., amortized over years vs. counted as a one-time cost), which can also distort ROI comparisons between departments or companies. Because of this lack of standardization, ROI figures can be easily manipulated—intentionally or not—to support a preferred narrative, making them unreliable unless the calculation methodology is clearly disclosed. That’s why ROI should always be accompanied by transparent assumptions and, ideally, supported by complementary metrics like NPV (Net Present Value), IRR (Internal Rate of Return), or payback period to provide a more complete financial picture.

- Ignores Scale and Duration – ROI alone doesn’t reflect the scale or length of an investment. A 50% ROI on a small, short-term project may be less impactful than a 20% ROI on a large-scale, multi-year initiative—but ROI alone doesn’t reveal that.

- Easily Manipulated – ROI can be manipulated by adjusting assumptions, inflating projected returns, or underestimating costs. Without transparency in inputs and methodology, ROI figures can be misleading or used to justify bias.

- Difficult to Apply to Multi-Faceted Projects – In complex initiatives with multiple objectives or overlapping investments, isolating the exact return can be difficult. This makes ROI calculation challenging or even misleading in areas like transformation projects or ecosystem partnerships.

- Doesn’t Show Causality – ROI measures correlation (input vs. output), but not causation. Just because an investment yielded a return doesn’t mean that it directly caused it. Other factors may have contributed to the outcome.

- Static and Retrospective – ROI is often calculated after the fact, making it more of a diagnostic than a predictive tool. It doesn’t provide insights into ongoing performance or help with real-time course correction.

- Fails in Contexts with Indirect Value – ROI is less useful in contexts where value is generated indirectly or over a long period, such as research & development, culture change, or innovation. These areas produce outcomes that are hard to quantify in financial terms.

- May Undervalue Innovation and Experimentation – Relying strictly on ROI can lead organizations to avoid experimentation or unproven ideas, even if they have high potential. This can stifle innovation and discourage creative risk-taking.

Alternative and Advanced ROI Metrics

Types of ROI Measurements

While standard ROI is useful, it has limitations—especially when it comes to complex, long-term, or risk-sensitive investments. The following financial metrics offer more nuanced insights by addressing factors like time, risk, and capital efficiency:

- Return on Invested Capital (ROIC) – ROIC measures how effectively a company uses its total invested capital (both debt and equity) to generate after-tax operating profit.

- Formula:

ROIC = NOPAT / Invested Capital - It’s a more sophisticated performance indicator than basic ROI because it focuses on core operating efficiency, excluding financing or tax advantages. Investors and analysts use ROIC to assess whether a company is creating real value above its cost of capital.

- Formula:

- Internal Rate of Return (IRR) – IRR is the discount rate that makes the net present value (NPV) of all future cash flows from a project equal to zero.

- It reflects the true annualized rate of return, accounting for the timing and magnitude of all future cash flows.

- IRR is particularly valuable for comparing projects with different durations or cash flow patterns, and is widely used in capital budgeting, venture capital, and private equity.

- Net Present Value (NPV) – NPV calculates the difference between the present value of future cash inflows and the present value of outflows, using a specified discount rate (usually the cost of capital).

- It gives you the absolute dollar value an investment is expected to generate (or lose) in today’s terms.

- A positive NPV indicates a profitable project, while a negative NPV signals a net loss. It’s ideal for evaluating long-term investments where cash flow timing matters.

- Payback Period – This metric measures how long it takes to recover the initial investment from the net cash inflows a project generates.

- While it doesn’t account for the time value of money or returns after the payback point, it provides a quick, risk-sensitive assessment—especially valuable when liquidity or cash flow is a priority.

- It’s often used alongside ROI or NPV to evaluate how quickly an investment begins to pay off, making it popular in industries with high capital intensity or shorter investment horizons.

How to Improve ROI

For Business Investments

- Increase Revenue – Boost income from existing investments through strategies like upselling, cross-selling, dynamic pricing, or entering new customer segments. Enhancing revenue without proportional cost increases can significantly improve ROI.

- Reduce Costs – Identify and eliminate non-essential expenses while maintaining operational efficiency. Cost reductions in areas like procurement, overhead, or automation can directly raise ROI without affecting quality.

- Optimize Asset Utilization – Ensure that physical, financial, and human assets are being used to their fullest potential. Idle resources (e.g., underused machinery or software licenses) represent sunk costs that drag down ROI.

- Reallocate Resources – Regularly assess performance across investments and shift capital or personnel away from underperforming initiatives toward those showing stronger returns or strategic potential.

- Shorten Project Timelines – Reducing the time to completion can help accelerate returns and lower time-related costs like labor, overhead, or financing, increasing the ROI of time-bound initiatives.

- Improve Data-Driven Decision-Making – Use data analytics and KPIs to identify inefficiencies, trends, and growth opportunities, allowing more precise, ROI-positive adjustments in strategy or execution.

For Marketing Investments

- Target Audience Refinement – Focus campaigns on high-converting audience segments through better use of customer data, personas, and behavioral targeting to reduce spend on unqualified leads.

- Channel Optimization – Analyze performance across all channels (e.g., email, SEO, PPC, social) and invest more in those delivering the highest ROI, while scaling back on low-performing or oversaturated platforms.

- Conversion Rate Optimization (CRO) – Enhance landing pages, website UX, forms, and calls-to-action to convert more traffic into leads or sales without increasing acquisition costs.

- Customer Lifetime Value (CLV) Focus – Shift attention from one-time transactions to strategies that increase retention, loyalty, and repeat purchases, such as loyalty programs, re-engagement emails, and personalized offers.

- A/B Testing and Experimentation – Continuously test creative assets, copy, and targeting strategies to refine performance and maximize return from each campaign iteration.

- Marketing Automation – Use tools like email workflows, retargeting, and CRM integration to increase efficiency and personalization while reducing manual effort.

For Technology Investments

- Phased Implementation – Roll out large or complex IT projects in smaller, manageable stages. This approach lowers risk, reduces disruption, and allows for early feedback to improve overall ROI.

- User Adoption Strategies – Ensure new tools or systems are fully adopted by the workforce through training, onboarding, and change management. A well-designed system is only valuable if it’s used correctly and consistently.

- Integration Efficiency – Ensure new technology is compatible with existing systems and workflows to avoid costly workarounds, duplication, or downtime that erode ROI.

- Automate Repetitive Tasks – Identify areas where automation (e.g., with AI, RPA, or custom scripts) can reduce manual labor and increase scalability, improving productivity and long-term return.

- Cloud Cost Optimization – Regularly monitor cloud usage, licensing, and storage to avoid over-provisioning or wasteful spending, which can quietly eat into ROI.

- Monitor Total Cost of Ownership (TCO) – Evaluate all related expenses over the lifecycle of a technology investment (including maintenance, training, upgrades), not just upfront costs, to get a true picture of ROI.

Examples of Using ROI in Action

Retail Industry Example

A retail chain invested $500,000 in a new inventory management system. After implementation, they reduced inventory holding costs by $150,000 annually and increased sales by $250,000 due to better product availability. The first-year ROI was:

ROI = ($150,000 + $250,000 - $500,000) / $500,000 × 100% = -20%

While negative in the first year, the three-year ROI was positive:

ROI = (($150,000 + $250,000) × 3 - $500,000) / $500,000 × 100% = 140%

This demonstrates the importance of considering time horizon in ROI calculations.

Digital Marketing Example

A B2B software company spent $50,000 on a digital marketing campaign including SEO, content marketing, and LinkedIn advertising. The campaign generated 200 leads, of which 15 converted to customers with an average deal size of $20,000.

Total revenue: 15 × $20,000 = $300,000

Assuming a 20% profit margin: $60,000 profit

ROI = ($60,000 - $50,000) / $50,000 × 100% = 20%

Human Resources Example

A company invested $100,000 in a leadership development program for 20 managers. After the program, they measured:

-

- Reduced turnover saving $150,000 in replacement costs

- Productivity improvements valued at $200,000

ROI = ($150,000 + $200,000 - $100,000) / $100,000 × 100% = 250%

ROI Best Practices

To ensure ROI calculations are meaningful, fair, and actionable, organizations should follow a set of proven best practices. These help reduce errors, avoid bias, and maximize the value of ROI as a decision-making tool:

- Define Clear Metrics – Before calculating ROI, clearly define what counts as a “return” in the specific context. This could include direct revenue, cost savings, productivity improvements, reduced churn, or other measurable outcomes. Without a clear definition, ROI calculations can be inconsistent, subjective, or misleading.

- Consider Time Frames – ROI should be measured over a time frame that matches the investment’s lifecycle. For short-term projects, quarterly ROI might suffice, but longer-term initiatives like R&D or infrastructure upgrades may need multi-year evaluation. This ensures that ROI reflects true value over time.

- Account for All Costs – Include all relevant and hidden costs in the investment, not just the obvious ones. This means factoring in:

- Initial capital outlay

- Operating and maintenance costs

- Internal resource time

- Opportunity costs (what you’re giving up elsewhere)

- Implementation and training costs

Comprehensive cost inclusion avoids overestimating ROI and leads to more accurate, responsible investment decisions.

- Use Consistent Methodology – Apply the same approach to calculating ROI across all investments, especially when comparing multiple initiatives. Inconsistent inputs (e.g. gross vs. net return, different cost baselines) can distort insights and lead to flawed prioritization.

- Combine With Other Metrics – Don’t rely on ROI alone. Use it alongside complementary metrics such as:

- Net Present Value (NPV) for time-value analysis

- Internal Rate of Return (IRR) for long-term returns

- Payback Period for liquidity assessment

- Non-financial KPIs (e.g. customer satisfaction, employee engagement)

This multi-metric approach provides a well-rounded evaluation and prevents oversimplification.

- Regularly Reassess – ROI is not a one-and-done calculation. Business environments, customer behavior, and cost structures change. Regularly re-evaluate ROI to track real-time performance, uncover deviations from expectations, and adjust strategies accordingly.

- Tailor ROI to Context – Customize ROI frameworks for different departments or types of investment. For example, marketing ROI might focus on customer acquisition cost (CAC) and lifetime value (CLV), while HR ROI could look at employee retention or performance metrics.

- Disclose Assumptions Transparently – Always document and communicate the assumptions used in ROI calculations. This improves credibility, facilitates internal review, and allows other stakeholders to interpret results in the right context.

- Use ROI to Inform, Not Just Justify – Don’t use ROI merely to retroactively justify decisions. Use it as a forward-looking planning tool to guide which projects to pursue and how to allocate resources efficiently.

- Include Qualitative Considerations – Recognize that some investments generate intangible benefits. Even if these are hard to quantify, acknowledging them (e.g. improved brand trust, employee morale) helps balance the financial view with strategic impact.

Was this article helpful?

Support us to keep up the good work and to provide you even better content. Your donations will be used to help students get access to quality content for free and pay our contributors’ salaries, who work hard to create this website content! Thank you for all your support!

Reaction to comment: Cancel reply